Do Catering Companies Get A 1099

Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Seber Tans Plc

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Seber Tans Plc

In general a caterers charges for food beverages and any services provided for a customers event are subject to sales tax.

Do catering companies get a 1099. April 8 2019 Introduction. What do you do when you get a 1099-MISC on January 31 that reports 8000 worth of income when you really only got paid 800 from the company. That doesnt have to be a single 600 party.

IncomeStatementsEWTtaxstateohus or by calling. June 1 2019 1046 AM If you received a Form 1099-MISC to report your income from your catering gig you are considered self-employed in the eyes of the IRS and your income and expenses must be reported on Schedule C. The exception to this rule is with paying attorneys.

You will need to provide a 1099 to any vendor who is a. Vendors who operate as C- or S-Corporations do not require a 1099. Beginning with tax year 2011 the IRS requires you to exclude certain payment types you made to a 1099 vendor on Form 1099-MISC that will be included on third party payment processors such as credit card companies PayPal etc.

You can elect to be removed from the next years mailing by signing up for email notification. If the company provided a service including parts and materials to your business that is 600 or more then you are required to send them a 1099 unless they are incorporated. Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway.

Non-resident alien person for IRS purpos es is any foreign entity eg foreign individual foreign company etc. The Substitute Form W-9 is NOT valid if completed by a non-resident alien person. Get help from a tax professional or use tax preparation software to prepare this form.

If you are purchasing the food from the catering company and they are not serving it this is not a service so you wouldnt send them a 1099. Caterers and Catering Services Tax Bulletin ST-110 TB-ST-110 Printer-Friendly Version PDF Issue Date. There may be time for.

W-2 Upload Frequently Asked Questions. Which means exempt from 1099 reporting and 3 They are a US. Sometimes described as the consummate catering industry insider he has one of the longest track records of management success in this most competitive sector.

This requirement applies to persons who in the course of a business sell consumer. You are running your own business to provide your catering services even if it was only one time. This bulletin will explain.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is. That business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation. As a consultant to caterers as well as to companies serving to the catering industry his client list numbers in the hundreds and includes the entire range of the industry from small.

Therefore there is NOT a Form 1099 filing requirement. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. If the company caters four quarterly parties and bills you 150 for each you still have to send the owner a 1099 form.

An independent contractor is any business that provides business. The 1099-MISC form is filed with the IRS for a given tax year along with the corporations other types of 1099s and W-2s. The Internal Revenue Service requires that all companies file 1099s for their independent contractors by the filing deadline.

1099Gs are available to view and print online through our Individual Online Services. Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers. 1099 Upload Frequently Asked Questions.

Whenever the Forms 1099 arrive dont ignore them. The IRS regulations for Form 1099-MISC are complex and every business situation is unique. Report the total you paid in box.

You need to file 1099 forms and have paid 1099 vendors. When you purchase something and it is delivered and that is where the service ends there is NO 1099 requirement as. A restaurant would be considered a service provider under the IRS.

The information in this article is intended to be a general overview and not to be used as detailed instructions for completing this form. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. You only have to file a Form 1099 if someone performs services as the first expert said.

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. Person including a US. Tell the payer immediately.

Who is a caterer how sales tax applies to sales by a.

1099 Tax Magic Use Tax Free Dollars To Hire The Expert Help You Need Wealth Factory

1099 Tax Magic Use Tax Free Dollars To Hire The Expert Help You Need Wealth Factory

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

1099 Form Fillable All Categories Bioseven Fillable Forms 1099 Tax Form Doctors Note Template

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

Prospect Sheet Customer Call Follow Up Call Sheet Catering Intended For Customer Contact Report Template 10 P Sales Report Template How To Plan Sales Skills

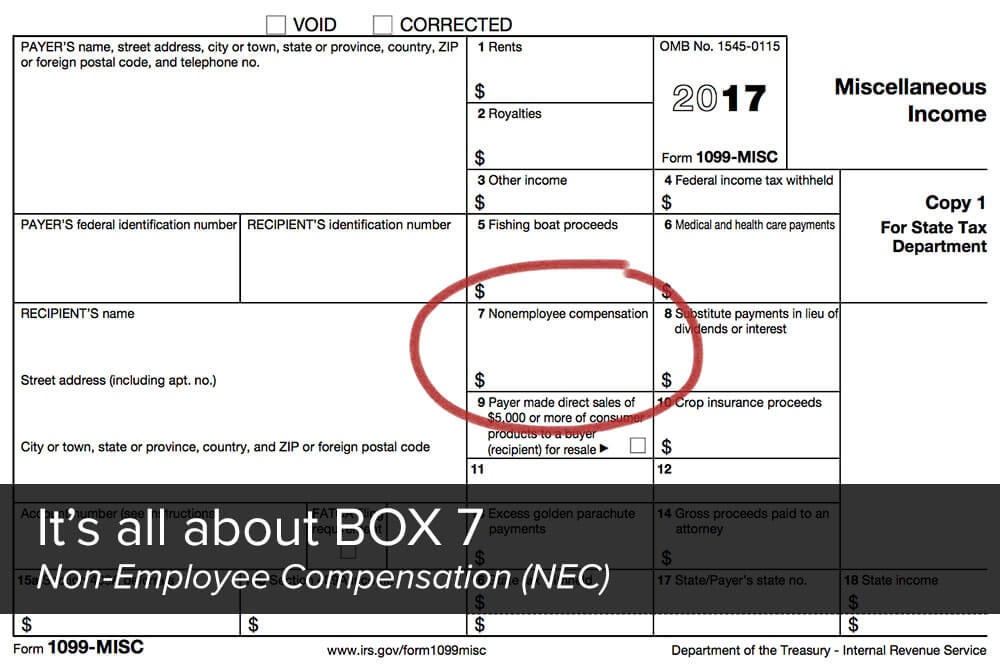

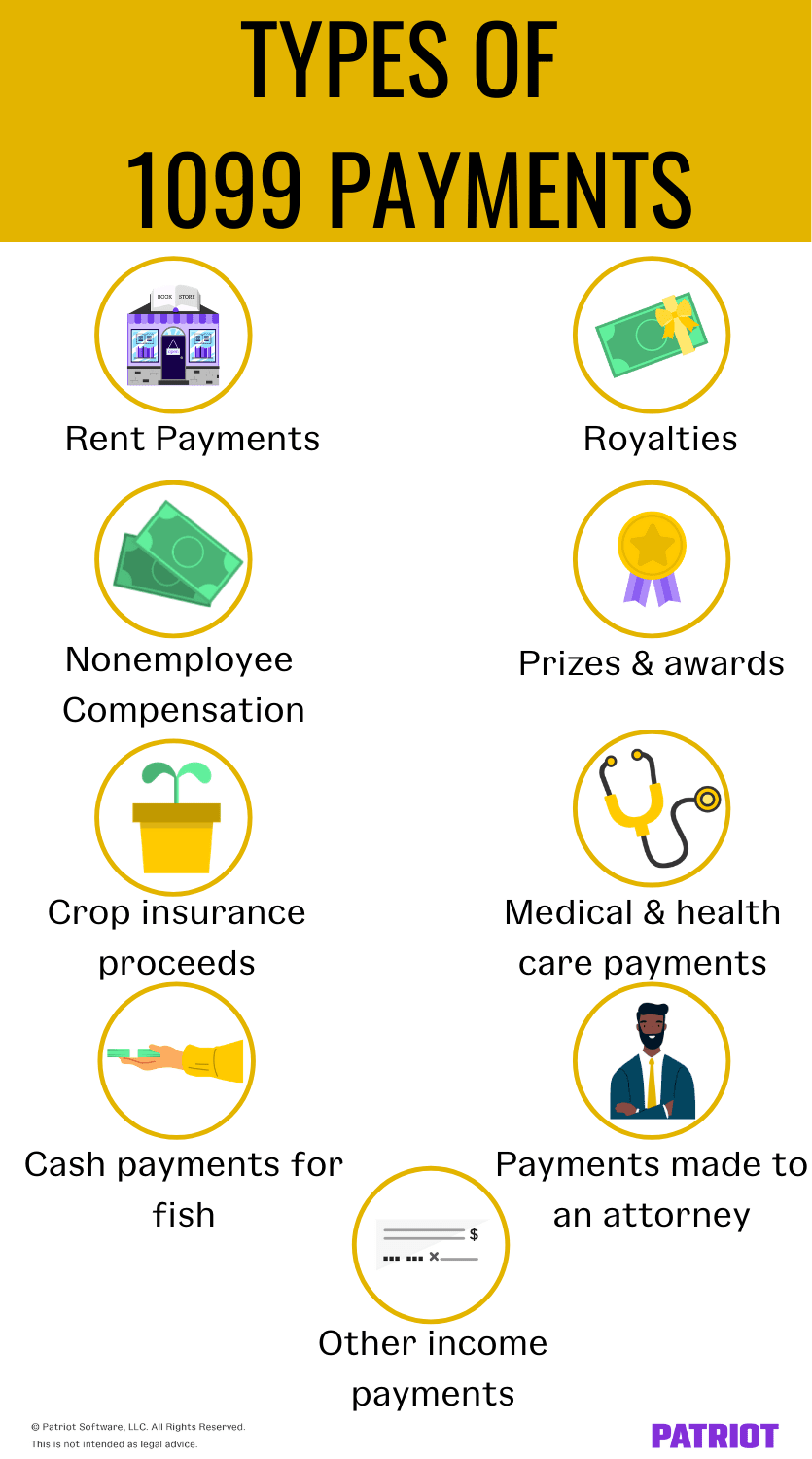

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Quickbooks 1099 Form Filing E File 1099 In Qb Pro Premier Payroll Enterprise

Quickbooks 1099 Form Filing E File 1099 In Qb Pro Premier Payroll Enterprise

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Postcard Flyer Print Design By Chai O 26 99designs Catering Asian Fusion Catering Design

Postcard Flyer Print Design By Chai O 26 99designs Catering Asian Fusion Catering Design

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Job Application Form

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Job Application Form

It Services Support For St Charles County Mo Managed Computer Services Small Business Tax Audit Business Tax

It Services Support For St Charles County Mo Managed Computer Services Small Business Tax Audit Business Tax

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

The 1099 Decoded The What Who Why How 1099s Small Business Accounting Business Management Degree Small Business Finance

Get Organized For Tax Season In 2021 Tax Season Working Mom Life Tax Appointment

Get Organized For Tax Season In 2021 Tax Season Working Mom Life Tax Appointment

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms